LAEDC has received the following information about the CARES Act relief for Americans in the federal package. Here are the details:

Coronavirus: Q&A related to individuals

Who qualifies to receive a check and how much will an individual receive?

Anyone who filed a tax return this year or last year. Individuals receive $1,200, married couples receive $2,400, and child dependents (under 17) receive $500.

What are qualified income levels based off of?

There is no qualified income threshold or requirement to receive the rebate. However, the rebate phases out at a 5 percent rate above adjusted gross incomes of $75,000 for single filers, $112,500 for heads of household, and $150,000 for joint filers.

Can those collecting Social Security or disability receive a check?

Yes, if they filed a tax return this year or last year, or received a form SSA-1099. Otherwise, they need to file a tax return.

How does an individual claim their check?

They do not need to claim their checks (unless they have not either filed a tax return this year or last year) — IRS will send out rebates automatically to their direct deposit or to the address provided on the last tax return submitted.

How long will it take for this check to be delivered?

Rebates sent via direct deposit will take a few weeks. Rebates sent via checks may take a few months.

Will I be taxed on this check?

No, rebates are not taxable.

Will I be eligible if I haven’t finished filing my 2018 taxes?

You need to have filed either a 2018 tax return or a 2019 tax return. If you have not filed either, you will not be eligible. You can file a 2019 tax return now to claim the rebate.

Will I be eligible if I have a lien against me, but I am in non-collect status?

Yes. Rebates will not be subject to garnishment, except if back child support is owed.

I withdrew my retirement in 2018- so my income that year was inflated. Is there any waiver for one time sources of income?

In this case, the taxpayer should file a 2019 tax return.

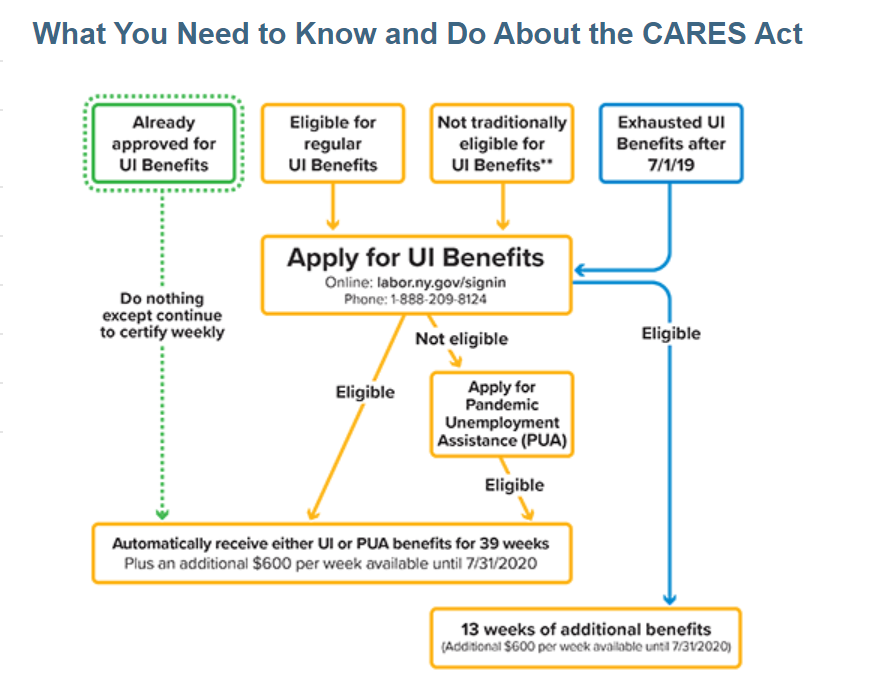

How much can I get from Unemployment Insurance?

The exact amount you can receive through Unemployment depends on your state and your previous earnings. Between now and July 31, an additional $600 will be added to every unemployment compensation check, so no one will receive less than $600 per week.

What if I’m not eligible for traditional Unemployment Insurance?

The CARES Act temporarily expands unemployment insurance to cover individuals who are not traditionally covered, including the self-employed, gig-workers, independent contractors, and workers with irregular work history. It also expands the list of allowable criteria for claiming unemployment compensation to include many reasons related to the COVID-19 public health emergency. Contact the unemployment office in the state where you worked to determine your eligibility.

What if I’ve been out of work because of COVID-19 for several weeks already?

If you exhaust the weeks of unemployment compensation available to you through your state’s laws, you will be eligible for an additional 13 weeks of benefits. These benefits will be federally-funded, but you will still receive them through your state.

How long will the expanded benefits be in place?

Expanded eligibility for unemployment insurance will be in effect until December 31, 2020. A $600 additional benefit will be added to unemployment compensation received for weeks between when the bill is enacted and July 31, 2020.

Is there a waiting period?

The CARES Act includes incentives for states to waive the waiting week between applying for unemployment compensation and receiving it. Contact the unemployment office in the state where you worked to determine whether there will be a waiting week.

How do I file for unemployment insurance?

You can apply for unemployment compensation through the unemployment office in the state where you worked. In most states, you can apply online.

Who is a covered employer?

In general, a private employer with fewer than 500 employees is a “covered employer” for both the paid sick leave and paid family leave requirements. However, the Secretary of Labor has additional authority to exempt employers with fewer than 50 employees from the requirement to provide leave for caring for children due to closures of schools or child care, both in the paid sick leave and paid family leave context. Additionally, employers of Health Care Providers or Emergency Responders have authority to unilaterally exclude their employees from all of the paid sick leave and paid family leave requirements. Finally, while most public employers with 1 or more employees are covered by the paid sick leave requirements and most public employers with fewer than 500 employees are covered by the paid family leave requirements, most federal employers are excluded from the paid family leave requirements–and OMB has the authority to exclude any federal employers from both the paid sick leave and paid family leave requirements.

Who is a covered employee?

To be a “covered employee,” an individual must first be working for a “covered employer” explained above. In general, an individual who is employed by a covered employer is covered by both the paid sick leave and paid family leave; the definition of “employee” is based in the Fair Labor Standards Act (FLSA) and is broad and intended to capture most people. However, paid family leave has an additional requirement that an individual has been employed by the employer for at least 30 days to qualify; if an individual was laid off by their employer after March 1, 2020, had worked for that employer for 30 of the 60 calendar days before being laid-off, and is re-hired by the employer, then that employee qualifies as a covered employee even though upon their rehire they have not been working for 30 days for the employer. Most federal employees are excluded from the paid family leave, and OMB has the authority to exclude any federal employees from both the paid sick leave and paid family leave.

How much paid sick leave are employees eligible to take?

For paid sick leave, employees are eligible to take up to 80 hours (two weeks) of paid time, depending on the employee’s regular schedule, at 100% of the employee’s regular rate of pay (up to $511 per day) due to quarantine/isolation order, health-care provider guidance to self-quarantine, or seeking diagnosis for symptoms of COVID-19; the pay is limited to 2/3 of the employee’s regular rate of pay (up to $200 per day) for caring for someone who is isolated/quarantined and for taking care of a child due to a closure of school or child care.

How much paid family leave are employees eligible to take?

For paid family leave, employees are eligible to take up to 10 additional weeks of paid time at 2/3 of the employee’s regular rate of pay (up to $200 per day) solely to take care of a minor child due to a closure of school or child care or the unavailability of a child care provider.

What are the qualifying reasons for leave?

For paid sick leave:

Unable to work or telework due to

– The employee is covered by a quarantine or isolation order by a federal, state, or local authority;

– The employee has been advised by a health care provider to self-quarantine due to concerns over COVID-19;

– The employee is experiencing symptoms of COVID-19 and is seeking diagnosis;

– The employee is caring for an individual who is covered by a quarantine or isolation order or who has been advised by a health care provider to self-quarantine;

– The employee is caring for a son or daughter if, due to COVID-19, the school or place of care is closed or if the child care provider is unavailable; or

– The employee is experiencing a “substantially similar condition” as specified by HHS and DOL.

For paid family leave:

The employee is unable to work or telework due to needing to care for a son or daughter under 18 years of age because, due to COVID-19, the child’s school or place of care is closed or the child’s child care provider is unavailable

Are there documentation requirements an employee must provide to prove they are caring for an individual or child whose school or place of care is closed?

If the need for paid family leave is foreseeable, an employee must provide the employer with notice as soon as practicable; and an employer may require reasonable notice procedures to receive paid sick leave. However, while DOL may clarify this through guidelines or regulation, we do not read the Act to allow an employer to require any documentation to prove the employee is caring for an individual or child.

When do these provisions go into effect?

According to DOL, they will go into effect on April 1 and will apply to leave taken between April 1 and December 31, 2020.

What has changed for income tax filing this year?

The tax filing due date has been extended to July 15. Tax returns and any income taxes owed will not be due until July 15.

Are there any changes to tax filing for businesses?

The income tax return due date for calendar year corporations has also been extended to July 15. Tax returns and any income taxes owed will not be due until July 15. Employers can defer paying the employer portion of certain payroll taxes through the end of 2020, with all 2020 deferred amounts due in two equal installments, one at the end of 2021, the other at the end of 2022. Deferral is not provided to employers that avail themselves of SBA 7(a) loans designated for payroll.

I am a frontline worker in need of child care. Does this bill help me?

Yes. States can use their funding through the Child Care and Development Block Grant (CCDBG) to provide child care assistance to health care sector employees, emergency responders, sanitation workers, and other workers that are deemed essential during the COVID-19 response by public officials.

Are there protections to prevent people from being shut off of their power, gas, and water utilities?

Utility service is regulated by the states rather than the federal government. Many states have ordered their utilities not to terminate service to customers during the crisis.

What resources are available to states and utilities to offset costs of power, water and fuel service that must remain online?

For eligible households, $900 million is included for the Low Income Home Energy Assistance Program to help low income households with heating and cooling in homes, weatherization, and energy-related low-cost home repairs or replacements. Under the Small Business Loans provided in the bill, utility costs (electricity, water, gas, trash, and internet services) are eligible costs for which loans can be provided. An additional $600 million is included for Community Services Block Grants to states, tribes and territories, which can be used to cover utility costs.

Is there any relief for upcoming rent, mortgage, and utility payments?

Any homeowner with an FHA, VA, USDA, 184/184A mortgage, or a mortgage backed by Fannie Mae or Freddie Mac, who is experiencing financial hardship is eligible for up to 6 months’ forbearance on their mortgage payments, with a possible extension for another 6 months. At the end of the forbearance, borrowers can work within each agency’s existing programs to help them get back on track with payments, but they will have to pay missed payments at some point during the loan, so if borrowers can pay they should continue to do so.

Renters who have trouble paying rent also have protections under the bill if they live in a property that has a federal subsidy or federally backed loan. Owners of these properties cannot file evictions or charge fees for nonpayment of rent for 120 days following enactment of the bill, and cannot issue a renter a notice to leave the property before 150 days after enactment. After this period renters will be responsible for making payments and getting back on track, so they should continue to make payments if they’re financially able to do so. Renters who receive housing subsidies such as public housing or Section 8 who have had their incomes fall should recertify their incomes with their public housing agency or property owner because it may lower the rent they owe.

Will homeowners be foreclosed on if they can’t make their loan payments?

The bill includes a 60-day foreclosure moratorium starting on March 18, 2020, for all federally-backed mortgage loans. Borrowers with FHA, VA, USDA, or 184/184A loans, or loans backed by Fannie Mae and Freddie Mac, will not see foreclosure actions and cannot be removed from their homes due to foreclosure during that time.

Will multifamily property owners be foreclosed on if they can’t make loan payments?

The bill provides owners of multifamily properties with federally backed loans having a financial hardship up to 90 days of forbearance on their loan payments. Property owners would have to request the forbearance and document their hardship in order to qualify, in 30-day increments. During a forbearance period, the property owner may not evict or initiate the eviction of a tenant for nonpayment of rent and may not charge the tenant any fees or penalties for nonpayment of rent. This protection applies to loans issued or backed by federal agencies (including FHA and USDA) or Fannie Mae and Freddie Mac.

Who does the rental eviction moratorium apply to?

This provision applies to all renters who live in properties that receive a federal subsidy, such as public housing, Section 8 rental assistance vouchers or subsidies, USDA rental housing assistance, or Low Income Housing Tax Credits. It also covers any renters in properties where the owner has a federally backed mortgage loan, which includes loans backed by the FHA, USDA, and Fannie Mae and Freddie Mac. This includes any size of property, from single family houses to multifamily apartment buildings.

I have a loan and I am worried that I won’t be able to make my monthly payments. What can I do?

Contact your lender directly. The CARES Act allows banks and credit unions more flexibility to work with borrowers affected by the COVID-19 pandemic.

Does bill provide any relief for consumers who can’t pay their bills?

This bill does not. This section of the bill only provides instruction on how lenders or creditors should report consumers who have received a forbearance or some other accommodation to help them make payments.

Individuals having problems paying their bills should contact their lenders directly. The CARES Act allows banks and credit unions more flexibility to work with borrowers affected by the COVID-19 pandemic.

We will continue to work to enact credit reporting relief for borrowers who are struggling to make their payments during this crisis.

Who can use the Fed lending facilities?

The Federal Reserve will design the facilities. According to government officials, we expect there to be potentially over a dozen different facilities. The legislation specifically indicates that there should be a facility for states, municipalities, and tribes, as well as a facility for medium-sized business that are not eligible for the SBA program. It will also be critical for the Fed to consider other needs, such as protecting homeowners and renters.

My small business is in financial trouble and I’m considering filing for bankruptcy — how does this bill help?

This bill allows more small businesses to reorganize under Chapter 11 using procedures that are less expensive and that allow small business owners to retain control of their operations through the bankruptcy reorganization process. Under this bill, small businesses with up to $7.5 million in debt can take advantage of these streamlined Chapter 11 procedures. This new relief will be available for one-year.

I have been in Chapter 13 bankruptcy for 3 years. I recently lost my job and I can’t afford my plan payments right now. I’m worried that I won’t be able to complete the Chapter 13 process — does this bill help me?

Yes. This bill allows individuals and families currently in Chapter 13 who are experiencing financial hardship due to the COVID-19 pandemic to request a modification of their Chapter 13 plans, including by extending their payments for up to 7 years. This new relief will be available for one-year.

If I receive a stimulus check from the federal government, will it impact my ability to file for bankruptcy?

No. Under this bill, stimulus checks from the federal government cannot be used to determine whether you are eligible for filing bankruptcy. And, if you file for Chapter 13 bankruptcy, you will not have to turn your stimulus check over to your creditors. This new relief will be available for one-year.

I do not have a Real ID-compliant identification but I am concerned about going to a crowded DMV in the coming months before the October 1, 2020 deadline — what should I do?

There is no need to visit a DMV just to obtain a REAL ID by October 1, 2020 because the deadline will be extended for one year, until October 1, 2021.

I have an elderly or ill family member in prison. Is there any opportunity for early release?

Yes. This bill gives the Director of the Bureau of Prisons expanded authority to release people who are serving the last year of their sentence to home confinement.

I am not being allowed to visit my family member in prison because of the coronavirus. Is there an alternative to in-person visits?

This bill instructs the Director of the Bureau of Prisons to do more to set up video visitation for inmates, free of charge.

I have a family member involved in the federal justice system, what is going to happen to their case?

This bill allows courts to hold some hearings by video, but only if the defendant agrees.

I’m an AmeriCorps member and I’m unable to complete my term of service as a result of COVID-19. What happens to my education award?

Many AmeriCorps members will have difficultly completing the required number of volunteer hours due to current limitations on volunteer opportunities. The CARES Act allows the Corporation for National and Community Service (CNCS) to have flexibility to waive the required number of volunteer hours so that members may still receive a full Segal Education Award even if their service was interrupted as a result of COVID-19. Additionally, the CARES Act increases the upper age limit for AmeriCorps members and expands the maximum term of service so that AmeriCorps members whose service was impacted by COVID-19 are able to re-enroll once the emergency is over.

—end—